By www.CentralBankNews.info The Bank of Japan (BOJ) maintained its target for asset purchases with the aim of increasing the monetary base by an annual pace of about 60-70 trillion yen.

The brief statement by the BOJ did not include any further details.

In April the BOJ embarked on a new and aggressive monetary easing with the aim of doubling the country’s monetary base – banks reserves and the central bank plus currency in circulation – in order to rid Japan of nearly 15 years of deflation and boost inflation to 2.0 percent in two years.

Since June, Japan’s consumer price inflation rate has turned positive, following 12 straight months of falling prices. In September Japan’s headline inflation rate rose to 1.1 percent from 0.91 percent in August.

Japan’s economy has also been strengthening, with the Gross Domestic Product up by an annual rate of 0.9 percent in the second quarter, up from 0.3 percent in the first quarter.

At its previous meeting, the BOJ repeated that the country’s economy was “recovering moderately” while the increase in consumer prices was likely to rise gradually.

www.CentralBankNews.info

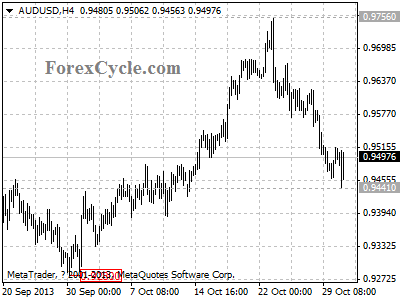

AUDUSD remains in downtrend from 0.9756

AUDUSD remains in downtrend from 0.9756, and the fall extends to as low as 0.9441. Resistance is at 0.9565, as long as this level holds, the downtrend could be expected to continue, and next target would be at 0.9350 area. On the upside, a break above 0.9565 resistance will indicate that the downtrend from 0.9756 had completed at 0.9441 already, then the following upward movement could bring price to 1.0000 zone.

Provided by ForexCycle.com

Picking Winning Stocks for Retirement

It’s day four of ‘Retirement Week’.

This afternoon your editor will sit down for a chat with retirement and superannuation expert Vern Gowdie, and Sound Money, Sound Investments editor Greg Canavan.

We’re broadcasting the discussion live. If you’ve registered for the event be sure to tune in to the conference call website in plenty of time.

The event starts at 2pm sharp.

So far this week we’ve looked at risk, asset allocation, and a simple way to set up an independent savings plan, starting with just one dollar per day.

In today’s Money Morning we’ll take things one step further. How to pick winning investments to make sure you have enough money to see you through retirement…

If you want to know how many ways there are to pick stocks, the answer is, more than you can imagine.

Of course, not all of them produce winners. In fact there isn’t a system or methodology that produces a winner on every trade. But somewhere there probably is a system that produces a loser on every trade!

But before we get on to the subject of picking winning stocks, remember that this is part of your overall strategy. Before you get to this stage you need to go through the steps we’ve covered so far this week. You need to understand risks, allocate your asset exposure, and save so that you can invest.

Once you’ve done that then you can start thinking about how you’ll select each investment based on the risk, where it fits into your asset allocation, and how much of your savings you’ll use.

You Can’t Pick Stocks Like You Pick a Meal

Easy right? Not quite.

Picking winning stocks isn’t like ordering an entrée, main course and dessert from a menu.

If you buy and sell shares based on fundamental investing (meaning that you look at what the company does and its financials) you could be a value investor, a growth investor, a speculator, an income investor, or a contrarian investor.

Or you could be a combination of those…or a different type of fundamental investor entirely.

If you buy and sell shares based on technical analysis (meaning you look at price charts) there are 1,001 different methods. You may trade long or short – or both. Or you may base your trading on Fibonacci, Gann or Elliot Wave theories.

And that’s just naming a handful. There are many, many other ways to trade using technical analysis.

By now we may have put you completely off the idea of being an active and independent investor. That would be a shame. But if that’s your decision, that’s fine. Active investing isn’t for everyone (check out Vern Gowdie’s essay below).

But if you can stick with it and develop an approach that you’re comfortable with, you stand a good chance of becoming a successful investor.

So, is there one approach that’s better than others?

The easy answer would be to say that Warren Buffett’s style of value investing is the best approach. After all, he’s the world’s richest man.

But it’s not as straightforward as that. What suits one person may not suit another. Every investor has his or her own personality. Thousands of investors try to follow Buffett, but with mixed success.

You Don’t Have to Reinvent the Wheel, but You Can Change it

So quite often the best thing to do when saving and investing for retirement is to develop your own approach.

It doesn’t mean reinventing the wheel; you just get to alter it a bit. Odds are you’ll take a bit of something from a number of sources. For your blue-chip growth stocks you may look for value.

For your income portfolio you may look for earnings growth. Or if you want income stability, something like Nick Hubble’s ‘Security Ladder’ may fit the bill.

And for your small-cap punting stocks you’ll probably look for pure speculation…the stocks that can give you the biggest bang for your buck.

In short, as much as we’d like to tell you that there’s one secret winning formula, it wouldn’t be true. What’s most important is to think carefully about the criteria we’ve discussed this week and then adapt it to your own needs.

If you do that you’ll stand a great chance of avoiding some of the big investing pitfalls (such as over-exposing your asset base to one asset class) while still giving yourself the best possible chance to achieve your retirement goals.

Cheers,

Kris+

From the Port Phillip Publishing Library

Special Report: Read This or Retire Poor

Confidence & Trust in Self Managed Superannuation Funds

Do you have confidence in your current superannuation manager? If not, do you have confidence in your own ability to administer your retirement capital?

If so, are you confident of not falling prey to a con(fidence) artist, such as property spruikers, quick buck merchants et al.?

Do you trust yourself to manage your superannuation money? If so, you’ll need your own Trust Deed.

Do you trust the Government to not change the legislation governing SMSFs?

These are tricky questions to answer.

On a number of levels, confidence and trust are synonymous with Self Managed Superannuation Funds (SMSF).

If the burgeoning numbers of SMSFs are any indication, then clearly confidence and trust (on all levels) are in abundant supply. But it wasn’t always so.

There was a time when personal superannuation funds were in decline.

The resurgence in confidence and trust started on 1 July 1994 – the day the Superannuation Industry Supervision Act 1993 (SISA) came into effect.

Prior to SISA, small personal super funds were lumped in with industry, employer and commercial funds for prudential regulation. The onerous administration demands made it uneconomical for small funds to justify their existence. Accountants had long been recommending their clients wind up the personal super funds and rollover the proceeds to retail superannuation funds.

Oh how the investment institutions would love for this to be the case today.

SISA recognized that smaller super funds were different to the much larger public offer funds. Small funds (fewer than five members) tended to be for family members and therefore needed less prudential oversight.

SISA was a game changer for SMSFs. Accountants changed their tune and the rest, as they say, is history.

In 1994 there were approximately 70,000 small super funds with assets totaling $12 Billion.

The fortunes of SMSFs were turned around in 1994, but 2007 gave the sector a real turbo boost.

In September 2007, S.67(4A) was inserted into SISA. Under this new section, SMSFs are allowed to borrow to acquire property providing they comply with certain conditions.

Australians love of property + the 2007 SISA amendment = Increased SMSF attractiveness.

In 2007 there were approximately 330,000 SMSFs.

The latest count from the ATO tells us there are over 500,000 SMSFs (this is a 50% increase from the 2007 numbers) with a combined asset base of $500 Billion.

This kind of growth is bound to attract the attention of the authorities, industry players and a gaggle of smarties.

SMSFs account for nearly 1/3 of all monies in super. Faced with this threat, it’s little wonder the public offer funds (industry and retail) are lobbying hard for tighter regulations to apply to SMSFs.

Recent press articles quoting the RBA’s concern about SMSFs being the driver behind the ‘property bubble‘ would be music to the ears of the public offer funds.

As far as the major super funds are concerned, the more negative press about the SMSF sector, the better.

Nothing focuses the attention of government agencies – ATO, ASIC, RBA and APRA – like the perception the public is abusing the government’s goodwill.

The official ATO data indicates (on the surface) that the majority is actually doing the right thing – using the tax effective structure to accumulate funds for their retirement.

According to the latest ATO data, 76% of SMSF assets are invested as follows:

Australian shares: 32%

Cash: 29%

Direct Property: 15%

The other 24% is invested in international shares, collectibles, unlisted trusts etc.

Contrary to popular press, only ¼ of the direct property is in residential property. The majority is invested in commercial property.

The attraction for business owners to establish an SMSF has long been the ability to purchase (with the existing balance or with borrowings) commercial property to be used by a business they own or control.

There are a number of benefits to having a business premise owned by your SMSF:

- Pay market based rent to your fund instead of a landlord

- Not having to fret about whether your lease will be renewed or not

- The business does not have to lock up a large amount of capital in the acquisition of its own premises.

- The ability to transfer an existing business premise to the fund as an in-specie contribution OR to extract cash from the fund.

- Any capital gains on the commercial property are potentially tax free (if the SMSF is in pension phase).

Members can also sell or transfer other business real property investments to their SMSF.

The significant acquisition of commercial property by SMSFs is not attracting any adverse headlines. Commercial property is boring.

Australians love houses. Therefore it is the ‘borrowing to invest’ in residential property that’s capturing the various government agencies’ and the media’s attention.

The real problem is not SMSFs investing in residential property.

The real problem is the con artists and spiv operators who have been quick to exploit the gullible investors’ ‘hot’ buttons of: save tax, take control of your money, buy ‘bricks and mortar’, own an investment property for only a few dollars a week, etc.

Once seduced by the smooth sales delivery, these ‘lambs to the slaughter’ establish an SMSF with modest savings and gear up (courtesy of the spiv’s mortgage lending mates) to buy an over-priced property. This type of two-tiered marketing has been going on for ages; it’s just that now, courtesy of the 2007 SISA amendments, the spruikers have a whole new deposit base to tap.

These slick promoters largely operate outside of system – direct property investment does not come under ASICs jurisdiction.

Unfortunately a few rotten apples spoil it for the vast majority of responsible SMSF trustees and advisers.

The combination of heightened government scrutiny, public offer fund lobbying and the actions of a very small percentage of unscrupulous trustees and operators, means SMSFs are certain to come under further regulatory control.

It’s unlikely we’ll revert to pre-1994 legislation. However trustees should be prepared for a more onerous compliance regime.

If you have an SMSF prepare yourself for more form filling.

For those thinking about an SMSF, be aware that an SMSF is not for everyone, in spite of what the zealous SMSF promoters may tell you.

The investment freedom offered by an SMSF does come with responsibility, extra administration and additional regulatory scrutiny. Understand this before you commit to switching your super funds.

An SMSF is an excellent tax-effective investment vehicle, provided you possess the following minimum requirements:

- Sufficient capital ($300,000+) to justify the establishment of the fund and to make the annual fees/charges economical.

- Good record keeping skills

- A desire and aptitude to take ownership of your investment strategy

And finally, listen to your gut.

You must have confidence and trust in the people advising you in all aspects of your SMSF. That includes administration, accounting, tax planning and investment strategy.

Vern Gowdie+

Chairman, Gowdie Family Wealth

New Zealand holds rate and still sees rate rises in 2014

By www.CentralBankNews.info New Zealand’s central bank maintained its official cash rate (OCR) at 2.5 percent, as widely expected, repeating that it expects to keep the rate steady for the rest of the year and “OCR increases will likely be required next year.

The Reserve Bank of New Zealand (RBNZ), which has held its rate steady since March 2011, also repeated last month’s statement, saying “the extent and timing of the rise in the policy rate will depend largely on the degree to which momentum in the housing market and construction sector spills over into broader demand and inflation pressures.”

New Zealand’s inflation rate – up to 1.4 percent in September from 0.7 percent in August – is expected to rise toward the bank’s 2.0 percent target midpoint as domestic demand picks up.

The New Zealand dollar, known as the kiwi, remains high and a headwind to the country’s exports, the bank said, adding that “sustained strength in the exchange rate that leads to lower inflationary pressure would provide the Bank with greater flexibility as to the timing and magnitude of future increases in the OCR.”

Another factor weighing on demand is fiscal consolidation.

The New Zealand dollar rose steadily against the U.S. dollar since early 2009 but dropped in early May and hit US$ 0.77 on Sept. 1 after a high of US$ 0.86 in mid-April But since then it has bounced back, trading at $0.82 today, unchanged on the year.

New Zealand’s economy expanded by an annual 2.5 percent in the second quarter, down from 2.7 percent in the first, and the RBNZ said the economy was estimated to have grown by more than 3 percent in the year to September and household spending was rising and reconstruction is strong, which will support the economy and at some point ease the housing shortage.

“In the meantime high house price inflation persists, especially in Auckland,” the bank said, referring to its oft-repeated concern that high house price inflation could compromise financial or price stability. It added, however, that recent restrictions on loan-to-value mortgages were expected to help slow down the rise in prices.

Economists expect the RBNZ to raise rates in March 2014.

www.CentralBankNews.info

Tesla Motors a Good Opportunity to Hunt for a Long

Article by Investazor.com

If you don’t remember our last analysis on Tesla Motors (Is Tesla’s Engine Still Going?), here you have an updated. The price of this stock got pretty close to the 200.00$ per share, but did not touch it. After a rejection the sellers managed to push the price back to a key support at 158.50 dollars per share.

Chart: TSLA, Daily

In the current state we can see a Hammer, candlestick pattern, which was formed on some higher volume, false breaking the support. If the price will break the 170$ level, we could see a rally back to the latest top or even to 200$ per share.

On the other hand we should not exclude the possibility of a longer correction move. If on a daily basis, the price will close under 158$ per share a Head and Shoulders pattern would be confirmed. The targets for this pattern are situated at 140.00$ per share and at 123.00$ per share. If the full target of the H&S will be hit, would mean a loss of 22.37% of the current price.

Our preferred scenario is still on the up side, taking into consideration the current trend. The trade setup includes a buying level at 170$, Stop at 153$ and a Take Profit at 200$ per share. Better signals could come after the companies earning report will be released. Until then keep an eye on the price action and the volume patterns.

The post Tesla Motors a Good Opportunity to Hunt for a Long appeared first on investazor.com.

The US Federal Reserve – a Wedding Crasher Trying to Leave YOU with its Bill

Free Report by Elliott Wave International

Ever heard of a wedding crasher? You know — that distant “cousin” who shows up uninvited, hangs around the open bar all night, chugs down double-everythings and falls on his butt on the dance floor — all before mysteriously vanishing and leaving his night of indulgence on the father of the bride’s tab.

You don’t want to be around when that bill comes due!

Well, as a quasi-government organization with the authority to suck down your hard-earned money through the act of inflation, the U.S. Federal Reserve is “that guy,” and you could be the responsible one left with its bill.

Did you know that the Fed has been inflating the supply of dollars at a stunning 33% annual rate over the past five years? Or that it plans to continue inflating the supply of dollars at least into 2014 and has kept open the possibility that it will do so indefinitely?

When the Fed’s party is over, who do you think will be left with the bill?

Not the Wall Street bankers! We’ve learned that lesson already.

It’s Main Street investors like you who get the bill.

But you can protect yourself — though your window of safety is closing rapidly.

Robert Prechter, market forecaster and leading opponent of the Federal Reserve, has just released a report that that will help you understand the risks of deflation that most mainstream sources cannot see because they are blinded by decades of inflationary Fed policy.

At just 8 pages, “How to Protect Your Money When the U.S. Debt Bill Comes Due” is a quick read — well worth any independent investor’s time.

Follow this link to download your free deflation-protection report now >>

P.S. There’s no obligation besides filling out a short form that tells Prechter’s firm where to send your free report.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world’s largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

U.S. Fed maintains QE, waits for evidence of progress

By www.CentralBankNews.info U.S. economic activity is continuing to expand at a moderate pace and the labor market has also improved further, but the Federal Reserve will “await more evidence that progress will be sustained before adjusting the pace of its purchases.”

The U.S. central bank practically repeated its statement from September, saying it would continue to purchase $85 billion worth of Treasuries and mortgage-backed securities a month to keep downward pressure on market interest rates and “reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase programs ends and the economic recovery strengthens.”

The only change to the Fed’s statement today from last month was a reference a slowdown in the housing sector’s recovery and it repeated that fiscal policy was restraining economic growth.

The Fed, which last month surprised financial markets by continuing the size of its asset purchases, was widely expected to maintain its policy stance given the negative impact of the recent shutdown of the Federal government and the uncertainty created by the political discussions over the debt ceiling.

For Emerging Market Exposure, Look Beyond BRICs — and Beyond EEM

By The Sizemore Letter

I’ve never been a big fan of the iShares MSCI Emerging Markets ETF (EEM) because I consider it to be one of the most poorly-named funds in history.

It’s a great ETF—so long as you’re looking for exposure to companies that have already emerged.

Up until its recent rebalancing, the two countries with the highest representation in the fund were South Korea and Taiwan. These two Asian tigers—which both have living standards comparable to Western Europe—are now ranked second and fourth among the ETF’s holdings, though the two largest individual stock holdings remain South Korea’s Samsung (SSNLF) and Taiwan’s Taiwan Semiconductor (TSM). Great companies, no doubt, but hardly “emerging market” stocks.

The Czech Republic and Poland—which are proud members of the European Union—are also represented in EEM, and up until very recently so was Israel—one of the most technologically advanced nations on earth.

So I’ll repeat my chief complaint about EEM—it’s an ETF that does not live up to its name as an “emerging market” investment option.

And what about the BRIC economies of Brazil, Russia, India and China? Would a fund targeting the BRICs, such as the SPDR S&P BRIC 40 (BIK) be a better option?

Only marginally. Let’s ignore for the time being that the BRIC countries have had terrible performance runs in the past couple of years and focus again on portfolio holdings. To start, Russia is not an “emerging market.” It’s a petrostate facing terminal population decline and a loss of economic influence as oil and gas production shifts to the United States. So, one fourth of the BRIC quartet should be uninvestable for anyone looking for long-term growth. And while China, India, and Brazil all have their selling points, these three countries do not by any stretch comprise the entire emerging market universe.

This brings me to an ETF that addresses this major shortcoming, the EG Shares Beyond BRICs ETF (BBRC), which is indexed to the FTSE Beyond BRICs Index. The ETF has a 75% weighting to more advanced emerging-market economies—such as Mexico, Indonesia, Turkey and South Africa—and a 25% weighting to up-and-coming frontier economies, such as Nigeria, Kenya and Vietnam.

Significantly, the index excludes the BRIC countries as well as South Korea and Taiwan. It’s a one-stop shop for the countries to which most investors have little or no exposure.

So, how are we to put this ETF to work?

Emerging Global Advisors, the managers of BBRC and several other innovative emerging-market ETFs, created some model portfolios using assorted emerging market ETFs (see page 21 of their report). There are different ways to implement this, but I would recommend something along the following lines:

- Ditch EEM or any mutual fund you might have that tracks the MSCI Emerging Market Index.

- Invest 40% of the portion of your portfolio dedicated to emerging markets to my favorite long-term emerging-market ETF holding, the EG Shares Emerging Market Consumer ETF (ECON).

- Invest 30% each to emerging market ETFs that track the BRICs and the “Beyond BRICs,” such as BIK and BBRC, respectively.

- Rebalance at least annually.

These weightings do not have to be particularly precise, and there is plenty of room for you to overweight or underweight any of these ETFs based on market conditions or valuations. The key here is to get broad exposure to the real underlying macro trend—the rise of the Emerging Market Consumer—and to avoid limiting your exposure to just a handful of countries that have already largely emerged.

Sizemore Capital is long ECON.

Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management. Click here to receive his FREE 8-part investing series that will not only show you which sectors will soar but also which stocks will deliver the highest returns. The series starts November 5 and includes a FREE copy of his 2014 Macro Trend Profit Report.

This article first appeared on Sizemore Insights as For Emerging Market Exposure, Look Beyond BRICs — and Beyond EEM

GBOT is now BOURSE AFRICA

Mauritius, Tuesday, 29th October 2013 – Global Board of Trade Ltd. (GBOT), the first international multi-asset class exchange from Mauritius will now be known as BOURSE AFRICA LIMITED (BOURSE AFRICA). The change in the name symbolizes the larger focus of the exchange towards Africa and the opportunities offered by the African Financial and Commodities Markets.

Mr. Rinsy Ansalam, MD & CEO of Bourse Africa (formerly GBOT), said: “The decision to change the name from GBOT to Bourse Africa is a representation of our absolute focus towards African Financial and commodity Markets. Bourse Africa endeavors to provide market participants with an efficient market for Africa centric risk management, trading, investing and capital raising needs.”

The exchange was formally launched on 15th October 2010 by Dr The Honourable Navinchandra Ramgoolam, GCSK, FRCP, Prime Minister of the Republic of Mauritius and went live with trading on 18th October 2010. Ever since its launch, the exchange has lived the spirit of innovation through various market and product development initiatives. Some of the landmark developments at the exchange include –

Successfully launched Contracts for Difference (CFDs) on commodities and currencies – the 1st exchange in Africa and 2nd in the world to introduce exchange traded CFDs

Collaborated with Nairobi Securities Exchange (NSE) and Ghana Stock Exchange (GSE) to introduce African equity index futures of both exchanges

Launched its financial markets education initiative titled “Empowerment & Development through ‘Global financial markets’ Education” (EDGE). Under the programme, over 100 workshops and seminars have been conducted in Mauritius, Ghana, Kenya, South Africa and Nigeria to create awareness on financial markets and educate participants

Extended trading hours, from 6.00 am to 6.00 pm (GMT) to enable the global investment community to trade vis-à-vis international markets

Created a modern co-location centre to provide proximity hosting for members to access market data within a short span of time hence, enabling the development of innovative low latency trading strategies

Introduced commodity futures, African and Global currency futures, CFDs on commodities and currencies.

Bourse Africa Clear Ltd. has been formed to act as the designated Clearing House of Bourse Africa, an independent entity licensed by the Financial Services Commission (FSC) of Mauritius.

Commenting on the developments, Mr. Rinsy Ansalam added that, “At Bourse Africa, we envision to be the global hub for Africa centric risk management, trading, investing and capital raising requirements. We are successfully progressing towards our vision through our market democratization initiatives that include – market education, product innovation, development of retail participation, pan African and global collaborations, state-of-the-art technology implementation that includes direct market access to clients and ensuring high level of support and service to all market participants.”

As a continuation of the strategy of product innovation, Bourse Africa, subject to regulatory approvals, is evaluating introduction of agro commodity futures, base metal futures, African equity index futures, interest rate futures, exchange traded funds (ETFs) and exchange traded notes (ETNs)

About BOURSE AFRICA (www.bourseafrica.com)

BOURSE AFRICA LIMITED (Bourse Africa) is the first international multi-asset class exchange from Mauritius that currently offers trading on three market segments viz., commodities, currencies and equities.

The exchange offers participants, from across the globe, access to a tech centric market that is regulated, liquid and transparent with efficient clearing and settlement systems. Bourse Africa’s state of the art infrastructure provides a world class platform for risk management, trading and investment on global and African products. The exchange is licensed and regulated by Financial Services Commission (FSC), Mauritius to offer trading in commodity derivatives, currency derivatives, equity cash and equity derivatives.

BOURSE AFRICA CLEAR LTD is the designated Clearing House of Bourse Africa and acts as the counterparty to its Clearing Members. The clearing house is an independent entity which is licensed by the Financial Services Commission (FSC) of Mauritius.

Bourse Africa is promoted by the Financial Technologies Group (www.ftindia.com), a global leader in setting up and operating tech-centric next generation exchanges in the emerging but fast growing economies from Africa to Asia and Middle East to South-East Asia.

For business or media enquiries, please contact – SANDEEP CHAGGER |

Safe Harbour statement

Certain statements with reference to the company’s future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. The Company from time to time, make additional written and oral forward-looking statements, and the company does not undertake to update any forward-looking statements that may be made from time to time by or on behalf of the company unless it is required by law.