Source: ForexYard

Despite low liquidity in the marketplace due to the Christmas holiday and a lack of economic indicators, the US dollar started off the week on a bullish note. Fears regarding the prospect of the US going over the “fiscal cliff” of spending cuts and tax increases at the beginning of the year were the main reason behind the safe-haven greenback’s upward momentum. Today, another slow news day means that traders will want to once again pay attention to any developments in the ongoing budget negotiations between President Obama and Congressional leaders.

Economic News

USD – US Budget Crisis may Impact Dollar Today

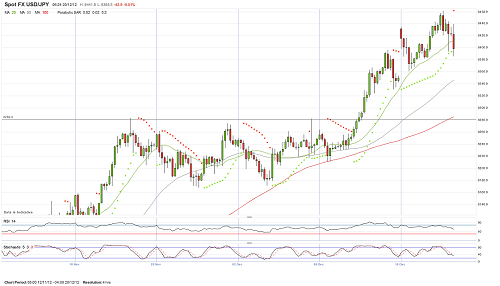

The safe-haven US dollar saw additional gains to start off the week, as concerns that the US could sink back into another recession if ongoing budget negotiations are not resolved led to risk aversion in the marketplace. The USD/CHF gained close to 40 pips during European trading on Monday, eventually reaching as high as 0.9163. The pair was last trading at 0.9153 when markets closed for Christmas. Against the JPY, the dollar gained more than 50 pips on Monday to reach a new 20-month high at 84.85.

Turning to today, another slow news day is expected, as most international markets remain closed. Still, the markets could see volatility as US lawmakers rush to reach a budget deal before a batch of automatic tax increases and spending cuts, known as the “fiscal cliff”, go into effect and threaten another recession. Any positive developments in the negotiations today will likely lead to risk taking among investors, which would likely lead to the dollar erasing some of its recent gains.

EUR – Progress in US Budget Talks Could Drive Euro Higher

The euro saw a mixed trading session to start off the week on Monday, as the ongoing deadlock in budget negotiations between US lawmakers led to risk aversion in the marketplace. The EUR/USD fell some 45 pips during afternoon trading to reach as low as 1.3173. By the time markets closed for Christmas, the pair was trading at 1.3189. The common currency had better luck against the Japanese yen, as speculations that the Bank of Japan will soon ease monetary policy further weighed down on the JPY. The EUR/JPY gained 75 pips during European trading, eventually reaching as high as 111.99.

Today, with several European markets still closed for the Christmas holiday, the euro is not forecasted to see significant volatility unless there is any news or announcements regarding the US “fiscal cliff” negotiations. Signs that the budget crisis is closer to being resolved are likely to lead to risk taking in the marketplace, which could boost the euro. At the same time, a lack of developments today may lead to additional risk aversion, which would send the euro lower against the USD.

Gold – Gold Prices Steady in Thin Trading

The price of gold took minor losses during trading on Monday, but a lack of significant news limited the precious metal’s bearish trend. By the time markets closed for Christmas, gold was trading at $1658.85 an ounce, down slightly more than $6 from the beginning of European trading.

Today, traders will want to note that the lack of significant economic indicators will make gold vulnerable to seemingly random price shifts. Any mention of the US “fiscal cliff” or the ongoing budget negotiations between US lawmakers may generate volatility in the price of gold.

Crude Oil – Crude Oil Prices Flat to Start Week

The price of crude oil saw very little movement ahead of the Christmas holiday on Monday due to the lack of developments in US “fiscal cliff” negotiations and international economic indicators. The commodity ended Monday’s session at $88.60 a barrel, down $0.30 for the day.

Today, crude oil prices are likely to see volatility if there are any announcements or developments in the US “fiscal cliff” negotiations. Signs of progress in the negotiations are likely to lead to risk taking among investors, which may boost oil as a result.

Technical News

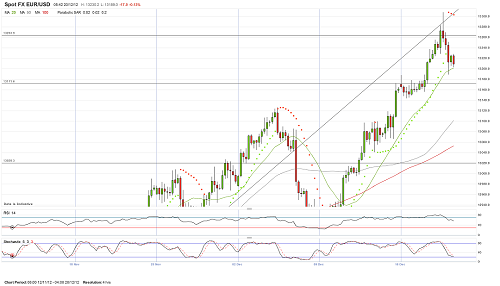

EUR/USD

The Williams Percent Range on the weekly chart has crossed over into overbought territory, signaling that a downward correction could occur in the near future. This theory is supported by the MACD/OsMA on the daily chart, which appears close to forming a bearish cross. Opening short positions may be best choice for this pair.

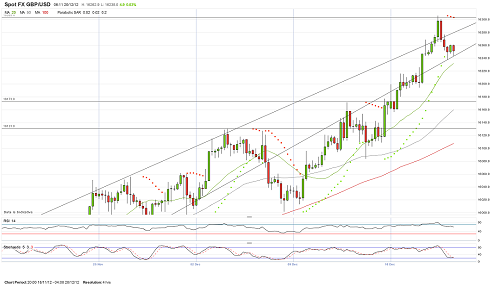

GBP/USD

While a bearish cross has formed on the daily chart’s MACD/OsMA, most other long-term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

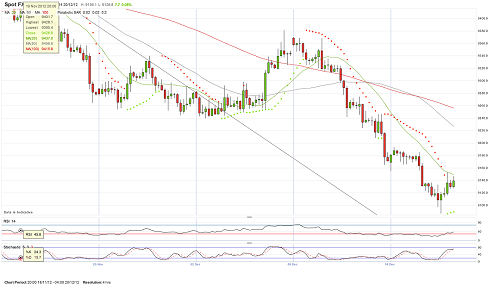

USD/JPY

The weekly chart’s Relative Strength Index has crossed over into overbought territory, indicating that a downward correction could occur in the coming days. Furthermore, the Slow Stochastic on the same chart has formed a bearish cross. Going short may be the best choice for this pair.

USD/CHF

The Bollinger Bands on the weekly chart are beginning to narrow, signaling that a price shift could occur in the near future. Additionally, the Williams Percent Range on the same chart has dropped into oversold territory, indicating that the price shift could be upward. Opening long positions may be the best choice for this pair.

The Wild Card

NZD/USD

The Williams Percent Range on the daily chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. Additionally, the Slow Stochastic is close to forming a bullish cross. This may be a good time for forex traders to open long positions for this pair.

Forex Market Analysis provided by ForexYard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.