I used to HATE listening to a local program called Shark Tank, where a group of Canadian “silver spoons” lecture the viewing public exactly WHY they were “so incredibly successful” in their abilities to take great ideas offered by young people and turn them into serious PERSONAL net worth enhancements.

One of the final group of “entrepreneurs” on that program in the early days was none other than Kevin O’Leary, the Canadian entrepreneur who made his fortune pitching The Learning Company (originally founded by O’Leary as “Softkey”) to Mattel Inc. for US$4.2 billion in what was later called “one of the most disastrous corporate acquisitions in recent history” as a US$50 million profit forecast turned into a US$105 million loss wiping out US$3 billion in Mattel’s market cap in a single day.

O’Leary was sued by Mattel and snuck away unscathed, but whether it was fined by Autorité des Marches Financiers for violations of the Securities Act (O’Leary Funds) or lawsuits by partners, he seems to have a habit of becoming embroiled in controversy.

The biggest controversy in a career that began in Toronto as a cat food brand manager for Nabisco came last year when he was cited as a spokesperson for FTX Corp. founded by Sam Bankman-Fried (“SBF”), who was this week convicted of defrauding investors of billions of dollars which were diverted from his crypto exchange to his personal hedge fund (Alameda) which in turn threw millions upon millions of dollars at people like Kevin O’Leary (and Tom Brady, Steph Curry, and supermodel Gisele Bündchen) as well as dozens of U.S. politicians (who have been noticeably reticent in returning any of the money.)

Now that the markets have once again spoken loudly in response to the somewhat dovish tone set out by Chairman Powell last Wednesday, the “Seasonality Trade” that I have been chirping about for the last three weeks looks to have finally arrived.

O’Leary continues to pump various products and services that seem to be on the thin edge of the knife, but for a celebrity pitchman who was seen every other week on BNN or CNBC spouting his esteemed opinion on everything from crypto (which he hated before FTX dumped US$10mm into his burgeoning bank account) to IRS tax tips, his career has now devolved into that of a carnival barker or snake-oil salesman.

Countless times, I have written about how decades of unbridled credit creation and deficit spending have created an environment of total disrespect for the purchasing power of a nation’s currency. No better example of how money corrupts was the recent book by one of my all-time favorite authors, the magnificent storyteller Michael Lewis (“Liar’s Poker,” “The Big Short,” “Boomerang”), chronicling the life of SBF that essentially absolves him of any “malice of intent” in his looting of billions of investor dollars while buying properties, sports teams, and political favor through illegal campaign contributions.

When I read the book (“Going Infinite – The Rise and Fall of a New Tycoon”), I came away horrified that an author who cut his teeth working on Wall Street — who wrote the book on shysters and confident men (and women) — could misread SBF and present him as an absent-minded dreamer with aspirations of saving the world from an “Artificial Intelligence Armageddon.”

This is what happens when money mysteriously shows up on a doorstep, and the finder has no idea how it got there. There is zero respect for what labor hours were required to create it or the identity of the people who originally earned it.

Politicians in Ottawa or Washington or London have zero interest in protecting the purchasing power of the savings of the voters they represent because those voters are more than happy flipping houses in a hot real estate market, and as long as the voter next to you gets hit with a tax increase, and you dodge the CRA or IRS bullet, all is good with the Federal deficit and life goes on.

I watched the cable coverage of the SBF verdict, and the talking heads on CNBC still look at SBF as a cult hero of sorts, with Jim Cramer trying to navigate around the fact that he called SBF “the new J.P. Morgan” back in 2022 but now refers to him as “an idiot,” a “con man,” a “pathological liar” in what has to be the greatest 180-degree opinion reversal in cable TV history.

Our entire culture has become a cultist culture where social media creates a myriad of causes that everyone with a cell phone can champion with little or no regard for consequences. You can sit in your mom’s basement and praise Sam Bankman-Fried for his entrepreneurial talents, and then, with the help of the keypad, delete everything you ever tweeted about the crook and deny you ever heard of him.

You can also call Leafs enforcer Ryan Reeves a “weak-kneed pansy” from the safety of cyberspace, knowing full well you would never say it while standing in front of him. In the era of “schoolyard judgment” in which I was raised, if you said something to someone that was out of line, you assumed that a knuckle sandwich was coming your way, and what that created was a “culture of accountability” in which you only said or did what you could back up. Applying that to today’s credit-addicted world, if politicians and central bankers were held accountable for 9% inflation rates and unaffordable house prices, it would be amazing how quickly the policies of the Bank of Canada or the U.S. Fed would change.

Only because Sam Bankman-Fried got caught did the MSM change their tune; now he is going to jail. Well, policy-makers were caught a year ago when the inflation rate hit 9%, and they are still worshipped, deified, and exalted as if they actually do “God’s work” in trashing domestic currencies the world over. Something is not exactly “right.”

Stocks

When the vast majority of the stock market “gurus” make a good call, they usually begin with the phrase “As I told you last week/month/quarter. . .” and then proceed to brag for the next three paragraphs about how much money they made their clients/subscribers/apostles.

I will not do that.

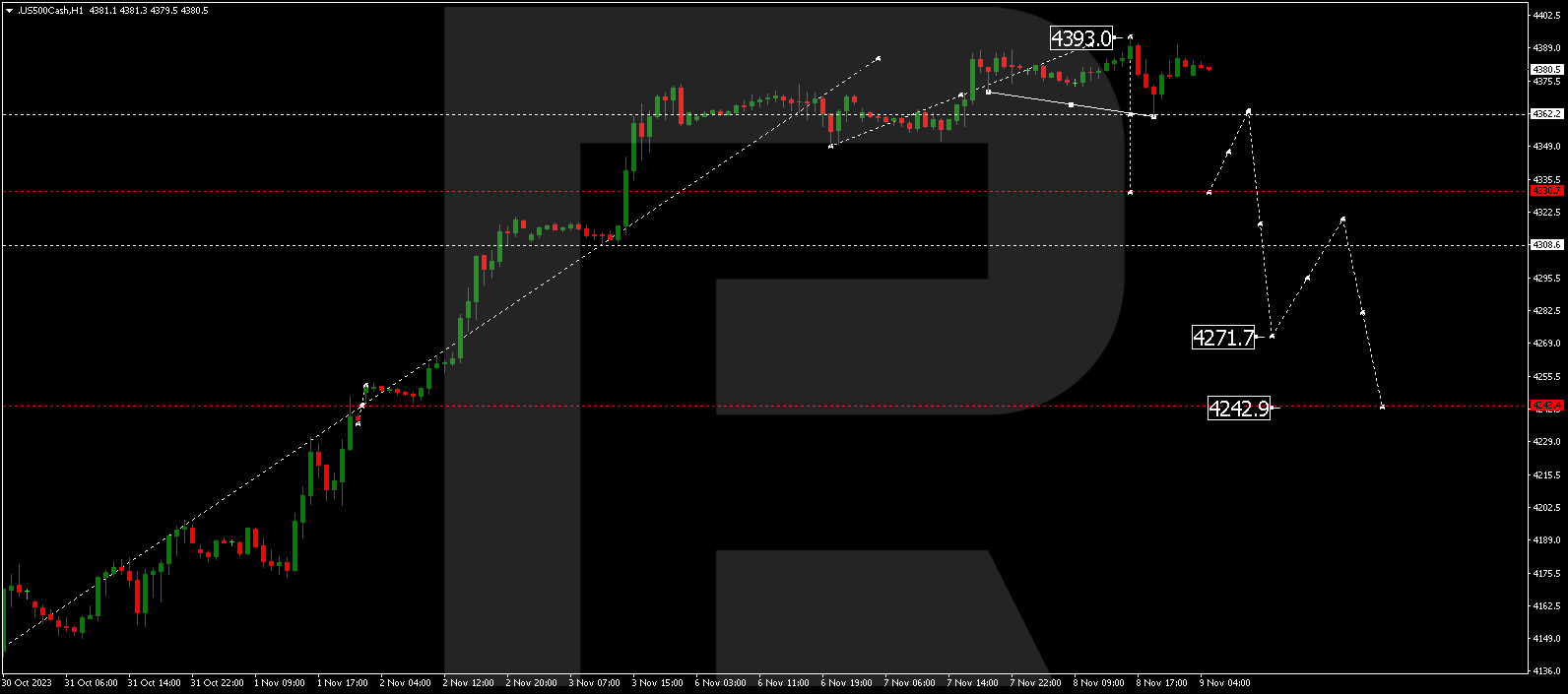

However, now that the markets have once again spoken loudly in response to the somewhat dovish tone set out by Chairman Powell last Wednesday, the “Seasonality Trade” that I have been chirping about for the last three weeks looks to have finally arrived.

More importantly, the trade that confirms this is the iShares 20+ Year Treasury Bond ETF (TLT:NYSE), which I have owned only for a couple of weeks, having bought it in the US$83 range with 10-year and 30-year yields punching out through 5%.

The 10-year yield hit 5.02% last week before a wicked rally kicked in, taking it right back down to 4.55% by Friday’s close.

The U.S. Dollar index had a huge crash to close out the week, dropping 1.01% to 104.90.

I see a move to the 100-dma at US$93.44 and then up to the 200-dma at US$97.71, with my ultimate objective being “somewhere north of US$100.”

I bought the SPDR S&P 500 ETF (SPY:NYSE) Dec US$445 calls in mid-October before the Israel-Hamas war broke out and elected to stick with them despite some fairly intensive selling in the latter part of the month. Luckily (or brilliantly), I sent out an Email Alert right after the Fed rate decision was announced buying the SPY:NYSE Dec US$425 calls, with the result being a three-day ride from the outhouse to the penthouse and a US$10k loss transforming itself into a US$12k gain.

With corporate buybacks kicking in and earnings season now behind us, it should be (operative word “should”) clear sailing until New Year’s, with the proviso being possible geopolitical flare-ups and/or inflation surprises. If I am right on the TLT:NYSE, I will be very right on the SPY:NYSE trade.

The other risk is that the macro outlook weakens sharply and much faster than the Street expects, but that is unlikely until Q1/2024.

Gold and Silver

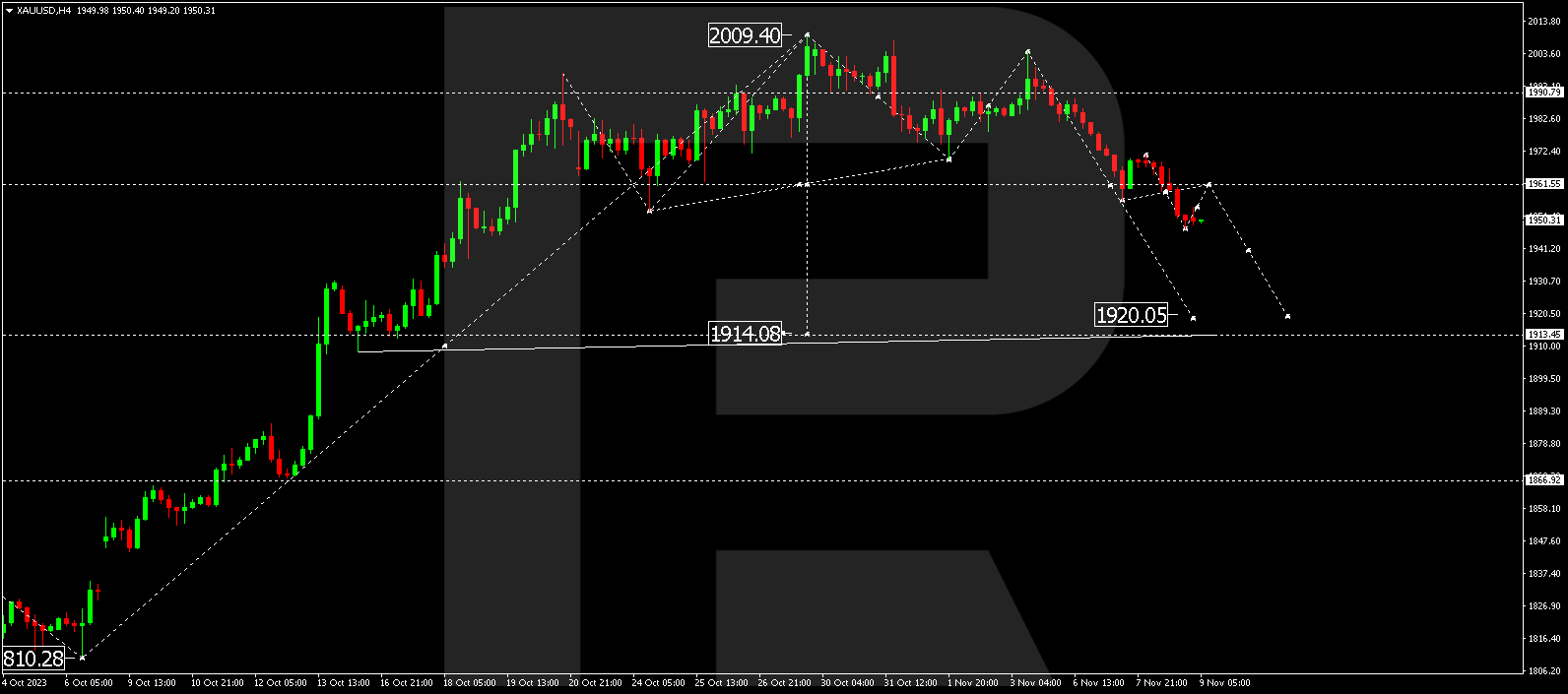

After the NFP numbers came out and the U.S. dollar began to tank, December Gold bolted out of the gate to US$2,012 and for a while appeared to be headed for a nice weekly close above US$2,000 but for some ungodly reason (tongue-in-cheek), sellers arrive, and prices leaked all the way to the Comex pit session ending with the weekly settlement price at US$1,999.20.

I fully expected to see a bunch of bullion bank traders thumbing their noses at us from the outer ring, giving each other the “wink, wink, nudge, nudge. Say-no-more, say-no-more” Eric Idle routine from Monty Python days.

I exited the SPDR Gold Shares ETF (GLD:NYSE) trade two weeks ago when it punched above my US$184 target price and continued up to US$186 before correcting back down under US$183. The good news is that silver had an excellent day, closing 2.14% higher versus gold’s 0.32% increase, and as I continue to preach ad nauseam, silver must get into gear and consistently outperform gold for the precious metals rally to sweep both metal and miners higher.

The gold miners had a good day on Friday, with the HUI tacking on 4.31%. I own the VanEck Gold Miners ETF (GDX:NYSEARCA:) and the December US$25 calls and the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT:NYSEARCA) and the December US$30 calls all at breakeven prices to close out the week.

Since the miners came down in October acting like “stocks” rather than “gold stocks,” they should (that operative word again) perform in line with the SPY:NYSE (and stock rally) until after New Year’s Day.

New Trade

I have been bullish on uranium since 2017, which means I have seen two rallies, neither of which I traded.

At the start of the year, I came up with the concept of the “Electrification Trilogy,” calling for increases in demand for new sources of electricity (nuclear/uranium), transmission infrastructure (wiring/copper), and electrical storage (batteries/lithium) and while I maintained exposure to copper and lithium, I really only had a small position in one uranium developer forgetting all the while that the best proxy for uranium has to be Cameco Corp. (CCO:TSX; CCJ:NYSE).

While I find it difficult to own any stock after it has nearly doubled, I listened to the conference call this week after they reported blow-out earnings, and what grabbed me by the throat was the forward guidance in which they said: “We are seeing durable, full-cycle demand growth across the nuclear energy industry.”

That is really positive guidance, and with 57 new reactors currently under construction around the globe and with Germany reversing their decision to dismantle three of their power plants, the demand for uranium is going to kick in long before new supply can hit the market.

Accordingly, I decided to bite the bullet and take a punt on a few Cameco March US$40 calls in the US$5.00 range on the assumption that I will see all-time highs above US$46.41 by New Year’s Day and US$50 in Q1/2024.

I know I am late to the party, but with guidance so powerfully bullish and nuclear the only real solution to the global energy problem, I cannot see getting hurt despite the modest overbought conditions it moved into on Friday before backing off.

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Article by

Article by