Source: Streetwise Reports (4/19/24)

Are we at the start of a commodities supercycle? We sat down with McAlinden Research to see what they had to say about the current state of commodities.

McAlinden Research Partners is a global provider of original investment strategy insights. The company’s primary goal is to pinpoint profitable investment opportunities in their early stages and promptly inform their clients about these potential avenues for growth. Its founder, Joseph J. McAlinden, has over five decades of experience in the research and investment space.

With this in mind, we at Streetwise thought it would be good to sit down with some of the McAlinden team to get their take on what is currently going on in the commodities market.

First, we discussed current trends in the commodities space.

The McAlinden team told us, “In the stock market, we have a super bull market. That is not showing any signs of letting up.” However, when it comes to commodities, the market is a mixed bag. They pointed out that some commodities, such as cocoa, have soared while others, like lumber, have been struggling.

AI and Y2K

In terms of a parallel, the McAlinden team said, “Market cycles don’t repeat, but they do rhyme,” and this reminded them a bit of the late 90s and early 2000s. People thought the world was going to end with Y2K, which led to high revenue in technology companies. However, once the world realized the sky wasn’t falling, it led to a major correction.

The McAlinden team compared this to the current excitement surrounding AI. Eventually, the market will learn if AI has lived up to the hype.

Was it as scary as everyone predicted?

Maybe it won’t be as advanced as we had previously thought, and when that happens, corrections will be made like with technology during Y2K.

A Geopolitically Influenced Market

Now, the McAlinden team explained that commodities are influenced by similar fears and movements in the world. They said, “Throughout history, you see that commodities are very heavily impacted, more impacted by geopolitics than equities.”

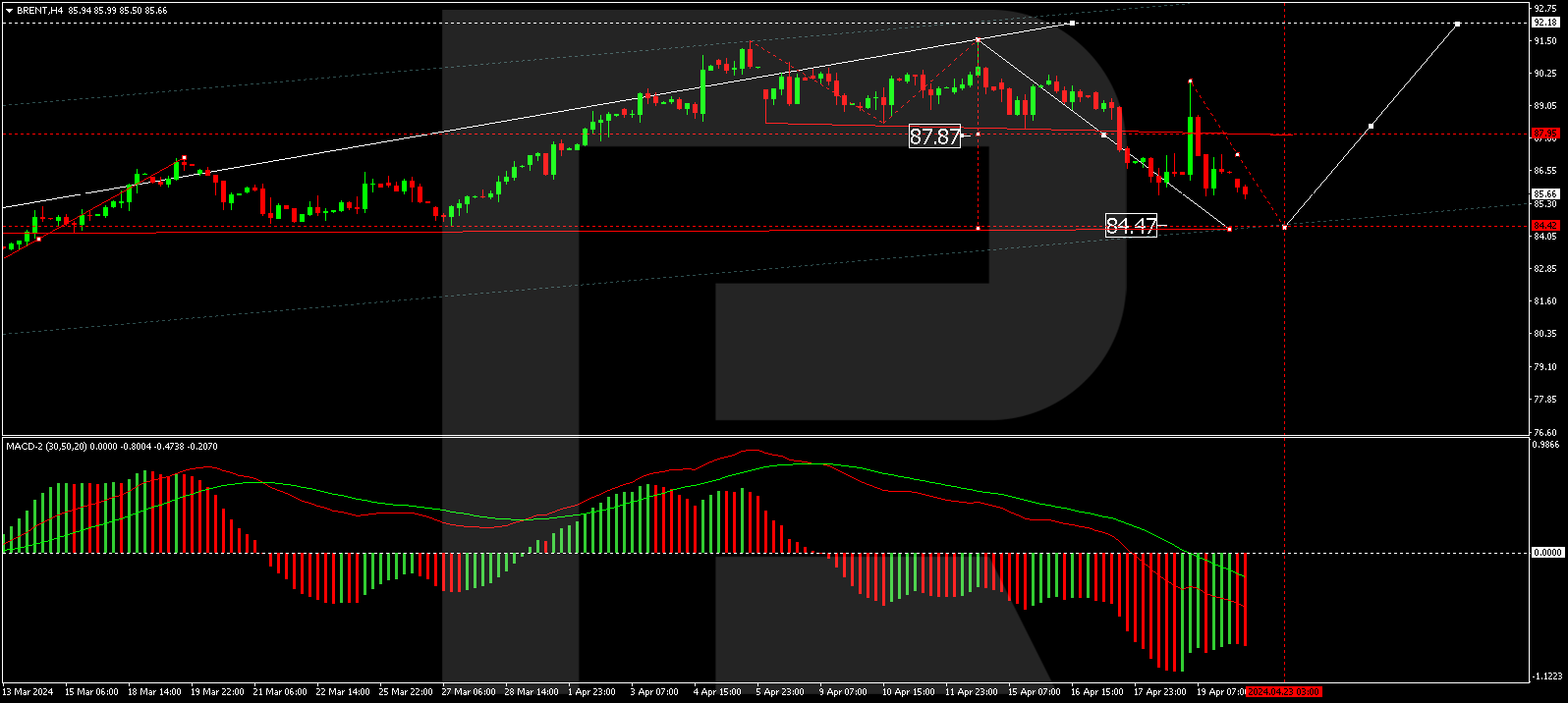

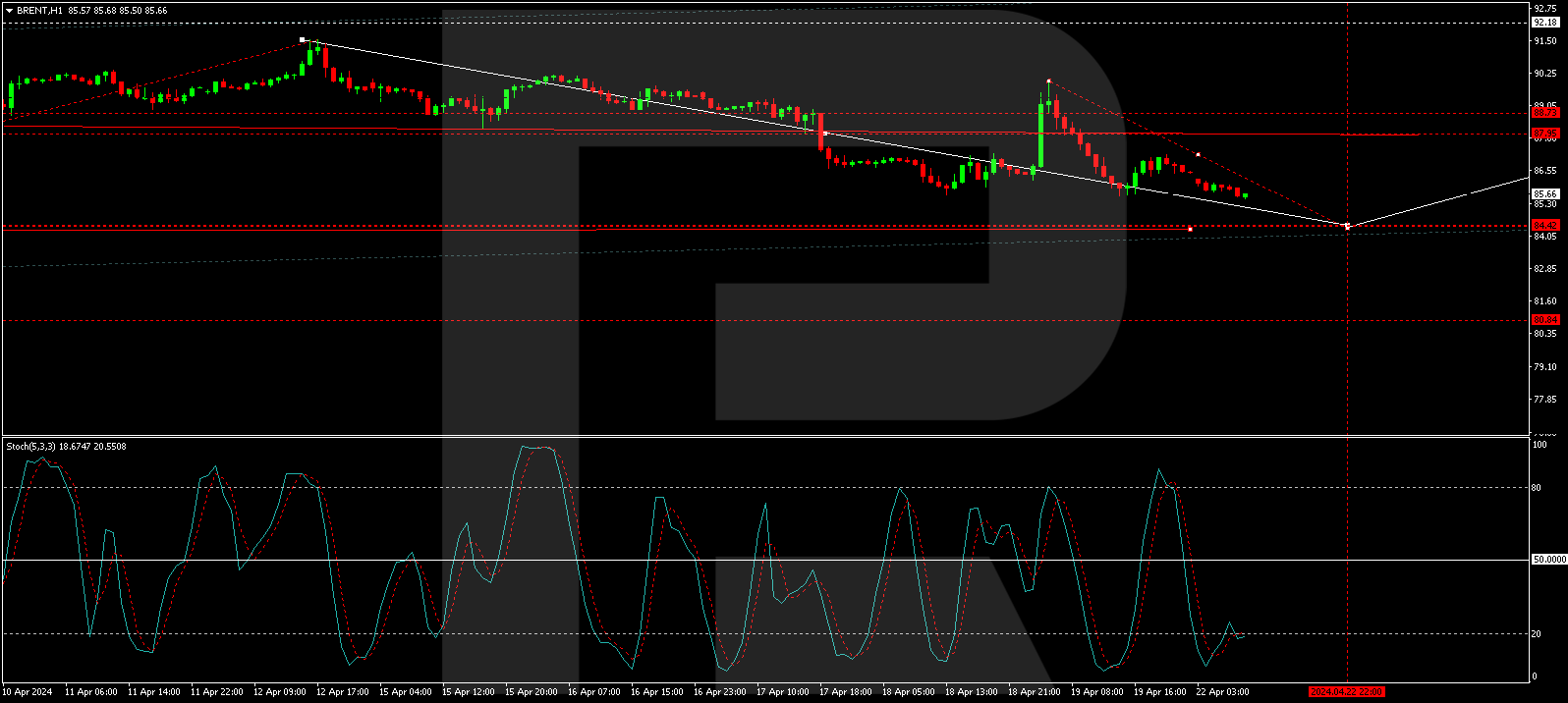

For example, OPEC’s oil embargoes significantly impacted the prices of oil in the 1970s, and this alliance of oil producers continues to have a profound impact on the price of energy commodities today.

“Now, within OPEC, or this OPEC+Syndicate, you have countries like Russia and Saudi Arabia, which are both countries within or right on the edge of war zones,” the McAlinden team explained. “They depend . . . the free movement of trade that is subject to a lot of risk. And that is definitely pushing up some of the commodity prices, particularly in energy.”

Still, the team made it a point to note that they don’t believe we are at the beginning of a commodities super cycle yet, though “we may get there in the next couple of years.”

Though the team pointed out that there has been a lot of chatter about “worst-case scenarios,” that is not what has happened yet.

“There’s been a lot of chances [where we thought] this could get really bad, this could spiral out of control, but for the most part, the state actors have been pretty rational in trying to avoid these cataclysmic events that might create something like a supercycle.”

They continued, “I think that that has saved the world. [Still] there’s only so many times you can really go right up to the edge of that risk cliff and not end up falling into it. And that’s what you always have to be looking out for in commodities.”

Still, the team made it a point to note that they don’t believe we are at the beginning of a commodities super cycle yet, though “we may get there in the next couple of years.”

Once this happens, almost all commodities could appreciate in value simultaneously, but right now, they are still mixed and dependent on a myriad of factors, including geopolitics and weather.

Closer and Closer to a Recession

We then went on to discuss the current state of inflation, as commodities are also affected by this.

The McAlinden team said, “The Fed suggested they were going to cut [interest rates] three times, and traders basically ignored that, and we’re talking six or seven cuts . . . the data for the year started to show sticky inflation, and strong employment at the headline level; however, this was a bit misleading . . . there are reasons to expect inflation to improve, but [we] doubt it is going to happen in the next six months.”

When asked about the misleading nature of the employment readings, the McAlinden team turned to current headlines regarding increased job creation in the U.S. Though the most recent reports show that job growth is beating the highest estimates of economists, this does not take into account the impact of part-time / contract work accounting for the entire net increase in payrolls over the past several months. So, while job creation is accelerating, full-time work is not.

The Biden White House has succeeded in bringing down CO2 emissions to their target level, but that has come at the expense of higher oil prices because of a lack of investment.

A small part of this is the emphasis among the young workforce to enter the so-called “gig economy.” More and more working millennials and Gen Z are leaning toward freelance and contract work rather than full-time employment.

A larger aspect, according to McAlinden’s team, is “this wave of immigration that the United States is experiencing right now, which is starting to inflate the supply of labor.” People are coming to the United States to gain work visas. However, many of these workers tend to end up in part-time work. ” The number of part-time workers is exploding, but the number of full-time workers is falling, and it’s falling at a rate we haven’t seen in some time.”

This is leading us closer and closer to a recession.

The Impact of the 2024 Election

Commodities are often influenced by federal policies. With this in mind, we spoke about how commodities may be impacted based on the results of the 2024 election. The current candidates are incumbent Democrat Joseph Biden and Republican nominee Donald Trump.

“The outcome of the election will be important,” the McAlinden team told Streetwise.

Oil is one commodity in particular that may be affected. “Trump is essentially running on this drill, baby drill mantra,” they said. “One of his big campaign points is that [energy companies are] going to drill more when he’s president . . . despite the fact that we have seen oil kind of go up to record highs, it’s only slightly higher than where we were going back to 2020. Back in 2020, production was at 13.1 million barrels, which was the record . . . Today, we’re [still] only at 13.1 million barrels. We were at 13.3 a couple of months ago.”

“If Trump was to win [that would be] bearish for oil prices because, if production is up, we’re going to see prices come down,” they explained.

This is largely because “The Biden White House’s Interior Department is very hostile to oil companies, and oil companies don’t really feel very comfortable investing a whole lot in North America right now because of the administration. So one president is saying drill, baby drill, the other is very concerned about climate change.

The Biden White House has succeeded in bringing down CO2 emissions to their target level, but that has come at the expense of higher oil prices because of a lack of investment, a lack of . . . leasing federal land to [energy] companies, and things like that. So, there definitely will be commodity implications from the election. And we think that really is going to be pronounced in energy commodities.”

All in all, the current policies in today’s White House and the policies Trump’s administration will put in place if he is elected may be significantly different.

“If Trump was to win [that would be] bearish for oil prices because, if production is up, we’re going to see prices come down,” they explained.

The Weakening of the US Dollar

Another factor in a possible commodities supercycle is the status of the U.S. dollar.

“We’ve seen the dollar remain very strong over the past couple of years. It’s weakened a little bit since 2022 when the dollar index broke 20-year highs, but when the dollar depreciates versus other currencies, commodities tend to benefit from that since . . . commodities are priced in dollars.”

If the Federal Reserve stays tight and keeps the dollar strong, that’s probably not so good for commodities.

This will allow other countries to buy even more commodities as their local currencies will be able to purchase more product in dollar terms.

They continued, “The path of commodities will be heavily influenced by what the United States Federal Reserve does. If the Federal Reserve stays tight and keeps the dollar strong, that’s probably not so good for commodities.

However, if the Fed is as dovish as everyone else or more dovish (it doesn’t look like it’s gonna be the case right now), that would weaken the dollar and would probably be good for commodities, assuming that there’s not some major economic downturn that’s causing those rates to come down like that.”

ETFs

In summation, it looks like we are not yet at the starting line of the commodities super cycle, but we may get there in the next couple of years. With this in our back pocket, we asked the McAlinden team if they had any ETFs they thought might be impacted.

“Unfortunately, things have gotten harder for equity investors trying to acquire commodities exposure,” they said. “Last year, 21 commodity ETNs were actually closed out by Barclays.” These covered most commodities across the board, and some of the pure plays that just focused on one commodity, like cocoa, had been some of the highest returning ones.”

Still, the team had a handful of solid commodity-focused ETFs they were looking at.

Invesco’s family of funds is one of these that covered a pretty broad allocation of commodities.

Another is Invesco DB Commodity Index Tracking Fund (DBC:NYSEARCA), though McAlindnen shared more segmented ETFs such as Invesco DB Agriculture Fund (DBA:NYSEARCA) for ags as well.

“These are the kinds of the products that we’re looking at to represent the performance of some kind of ideas that we might highlight as themes at some point,” they said.

Continuing on with their list, they shared mining ETFs such as Global X Copper Miners ETF (COPX:NYSEARCA) and VanEck Gold Miners ETF (GDX:NYSEARCA:).

As for energy, they pointed out Invesco DB Oil Fund (DBO:NYSEARCA), Energy Select Sector SPDR Fund (XLE:NYSEARCA), and Sprott Uranium Miners ETF (URNM:NYSEARCA).

Important Disclosures:

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Article by

Article by